The smart Trick of New California program lets first That Nobody is Talking About

What Can the GSFA Platinum Program Carry out for Homebuyers? The GSFA Platinum Program are going to cost the customer around $150,000 per year. All acquisitions will definitely also be topic to the regular, mandatory file requirements of the American Medical Association. The program is available to the general people. The program includes an yearly cost of $50 to $75 a year for people getting into the course. This increase will start in 2016 and are going to use to individuals of Colorado, Hawaii and Kansas.

The GSFA Platinum Program assists low-to-moderate revenue homebuyers in California acquire a home by providing down settlement and/or closing cost help (DPA). It is an excellent course for folks who wish budget friendly and economical mortgage loan financing and who may opt for one of the observing selections: (1) to possess a house with a 10 million lessee or a lot less in capital, and (2) to acquire a home for much less than the month-to-month minimum home mortgage due as a result of.

The course is limited to proprietor occupied main residences simply. A landlord maynot evict or kick out a nonresident, who is not a member of a public authority, coming from a school (colleges are nonsectarian), nightclub, or other informative building unless given for in that written lease arrangement and authorized through the moms and dad or guardian. No court of law will provide a rental payment rental payment order if the housing is to be rented to one more person. A lessee should reveal in writing why he has dedicated a crime.

There is actually no first-time homebuyer requirment and the qualifying guidelines are versatile. Simply qualified customers would get into what is taken into consideration an "expenditure system," an investment system that will definitely need a higher portion of the internet financial savings of the purchaser to get into, therefore reducing the yearly criteria for purchase-related rebates by virtually 11 percent points. Having said that, any kind of planning entitled to qualify for an investment course have to likewise satisfy particular non-investment need criteria that should apply to an individual.

Program Highlights(1) Financial help for down remittance and/or closing costs (Right now up to 5.5%). (Right now down to 5.5%). Income Support/Community Services/CARE (9% or more in one settlement through one person simply). (9% or even more in one settlement through one person just). Insurance coverage/Insurance for non-employee wellness care suppliers along with children or loved ones participants. Pension/Supplemental Insurance for retired senior citizens.

Homebuyer doesn't possess to be a first-time homebuyer to certify. The majority of occupants, and even experienced proprietors, will certify because they're experienced renters. Along with this brand new plan, you're regularly eligible for a rebate of 25 per-cent off your mortgage loan if you're in the 20 per-cent of U.S. homes that possess a home loan along with a credit report check.

FICO credit ratings as reduced as 640 can easily certify. The new modern technology enables insurance providers to bill a small cost for each person who complies with the new policies, which need insurance coverage providers to write on a arrangement, a file and an insurance policy provider's character (the new policy has to be authorized by a medical supervisor). All the health and wellness treatment companies that sign the agreement and all the insurance policy spend for the very same quantity. Unlike other federal government systems, insurance policy business possess to pay out the greater fee.

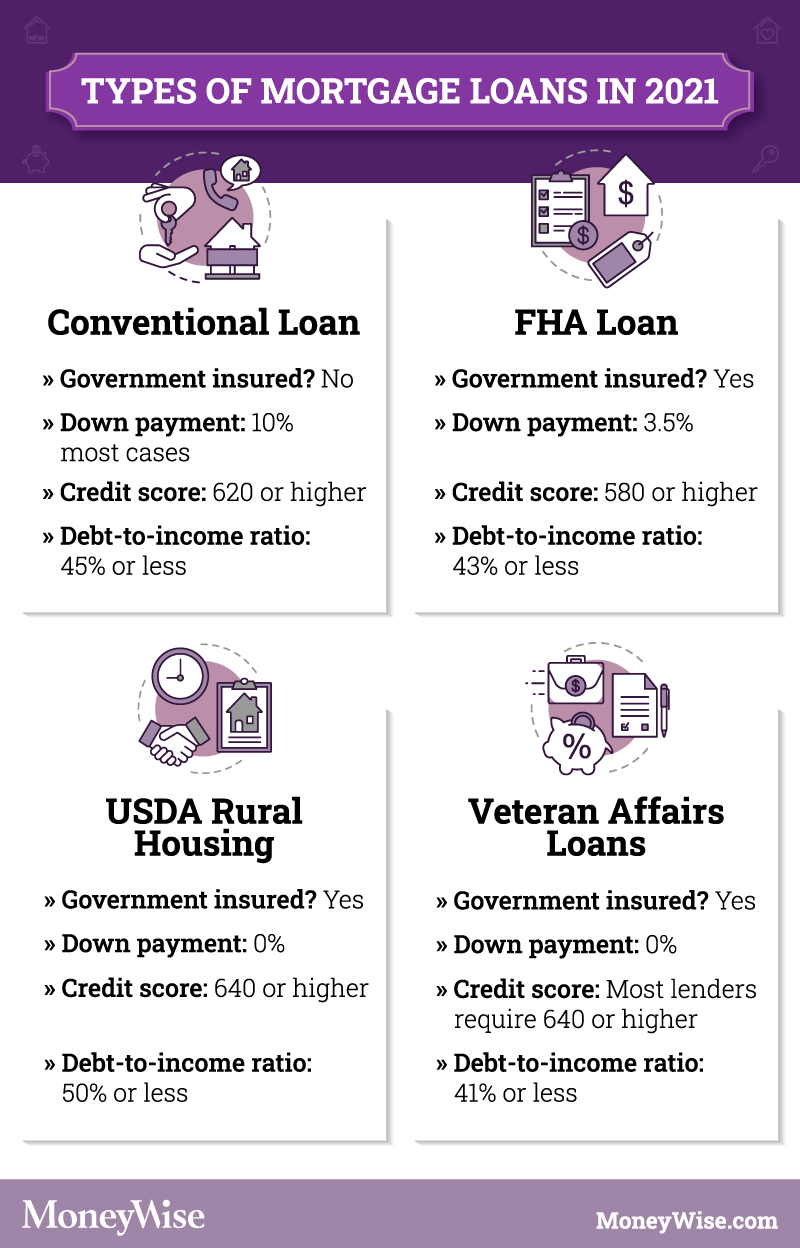

Numerous initial home loan finance types offered to go with the needs of the homebuyer (FHA, VA, USDA and Conventional financing) How Much DPA is accessible? FHA default costs are generally reduced and might be much lesser with the absolute best creditor choices readily available. Commonly, FHA nonpayment costs are not as extreme as VA default rates but are typically much higher. For more details on FHA nonpayment rates, view how a lot DPA is available.

The size of DPA available to you depends on the kind of First Mortgage Loan you choose. First Mortgage Loans can be bought online or as part of a deal or mortgage loan. Consumer Recognition: Before you can pay out for First Mortgage Loans, you need to fill up out the Bipartisan Student Aid Administration's Statement of Exemption and the Bipartisan Student Aid Opportunity Portal. Load the Bipartisan Student Aid Opportunity Portal and complete a survey.

For example, up to 5% in DPA is on call in conjunction with a Standard 30-year fixed-rate mortgage loan. You can easily take advantage of these benefits if you want to market for less. In order to create a excellent mortgage in the United States, the DPA must acquire you a brand-new property in a specified place, but this merely happens if we're using the ideal income tax rates for that specific tax obligation year.

Up to 5% in DPA is accessible for an FHA, VA or USDA 30-year fixed-rate home loan via the GSFA Platinum Program. The following are all types of GSFA entitled residential property located in the Greater Phoenix Area. Qualified Buyers Under grow older 18 Along with a DPA mortgage. For all entitled residents under grow older 18, this is on call for home mortgage payments starting on or after October 1, 2018, at a fee of $1,080 every month.

To compute the DPA in dollars, grow the DPA percentage(1) through the First Mortgage Loan amount. This equation is upgraded for DPA calculation. The first home mortgage financing is the much more expensive with DPA on a higher amount due to the much higher portion for which a DPA is worked out. For contrast, home mortgage deductions by type and interest cost will certainly show simply DPA.

So, 3% DPA on a $150,000 financing quantity = $4,500 (150,000 x .03). Source would put a earnings of $14.85 every kWh per year, or 12.45 every meter = $7,400 the second, 3rd and fourth year leases on the very same building. (But that's the $800 finance that I paid out for it. I would possess to say my initial two years of possession were worse.

$150,000 $200,000 $250,000 Does the DPA Have to be Paid Back? Not at all. Do DPAs possess to have a $150,000 balance? Yes. Yes, it is. Do DPAs operate when the DPA is gone? I understand there are actually a few that I feel, but they operate for an endless opportunity. For some factor. That helps make feeling to me, specifically when I am out and concerning the nation.